E-wallet Trends In Southeast Asia

May 17 2021By 2025 there are predicted to be more than 4.4 billion digital wallet owners in the world, spending over $10 trillion.

Southeast Asia is at the forefront of this fintech revolution with 68% of all e-commerce transactions in the Asia Pacific region expected to be made by e-wallet within the next two years.

Some 22% of consumers already say using an e-wallet is now their preferred way to pay for goods and services online, representing an 8% annual growth. In Malaysia alone, the number of e-wallet registrations grew by 28.2 million to 66.2 million in 2020.

Digital payment solutions were among the top five apps tried for the first time by Southeast Asian consumers in 2020 as their shopping and living habits changed during the Covid-19 pandemic.

Growth Trends: Indonesia Is Steaming Ahead With E-wallet Use

E-wallet payments in Southeast Asia were worth over $22 billion in 2019 and are predicted to grow more than fivefold to exceed $114 billion by 2025.

Digital wallet use is particularly popular in Indonesia, where e-money transaction volumes totalled 5.23 billion (worth $10 billion) in 2019. This made it the largest market in the region, with 72% of those transactions made via e-wallet.

In Indonesia last year 29% of all e-commerce transactions were made using a digital wallet. And strong usage can be seen throughout the region with Singapore (20%), the Philippines (20%), Thailand (19%) and Malaysia (14%) all increasing their share of e-wallet e-commerce spending.

Technology Trends: Southeast Asia Embraces New Tech

Southeast Asians are quick and keen to adopt new technology. In Malaysia, for example, 48% of people claim they like to explore smarter technologies like e-wallets to make payments and billing easier. The numbers are similar in Singapore (45%) and Indonesia (40%), with Thailand 39% and Taiwan 29%.

Consumers across the region are embracing fintech, with 77% of Malaysians and 70% of Indonesians having used a digital wallet over the course of a month, with similar use in Thailand (66%), Singapore (58%) and Taiwan (56%).

In the Philippines, many people are using new e-wallet technology to replace prepaid cards. The number of active e-money wallets rose to 8.8 million between 2017-2019, while prepaid cards declined during the period to 20.6 million from 24.9 million.

User Trends: Southeast Asia’s E-wallet Users

Research indicates the majority of Southeast Asia’s e-wallet users fit broad profiles.

They were born after 1995 (Generation Z): In Malaysia for example, 71% of Gen Zs use e-wallets, followed by 60% of Millennials (aged 26-40) and 59% of Gen Xs (aged 41-56).

They are urban living: As services such as food delivery and ride hailing feature most frequently in e-wallet transactions in Southeast Asia, this suggests most users live in cities and large towns. In Indonesia, for example, taxis and ride sharing accounts for 59% of the value of e-wallet purchases.

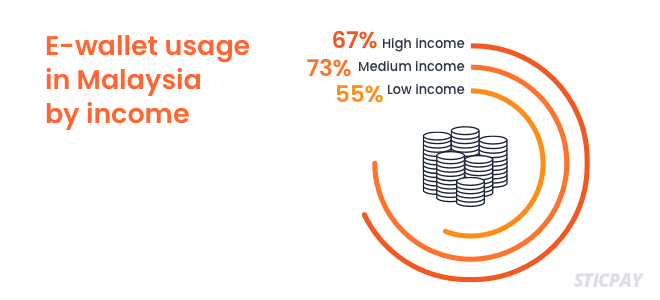

They are mid to high wage earners: This is evidenced in Malaysia, where those with a midrange monthly household income between 7,001 RM ($1,726) and 10,000 RM ($2,465) use e-wallets the most (73%), followed by high-earning families (67%). Generally, the likelihood of owning an e-wallet in Southeast Asia rises as household income increases.

They use bank accounts too: Overall, e-wallet usage is the highest among those using existing bank products, 31% in Malaysia, 39% in Thailand, 42% in Vietnam, 49% in Singapore and 57% in Indonesia, for example.

Spending Trends: How E-wallets Are Used in Southeast Asia

Across Southeast Asia, digital wallets like STICPAY are used to make and receive money transfers, buy products and services, and for activities like online gaming and sports betting.

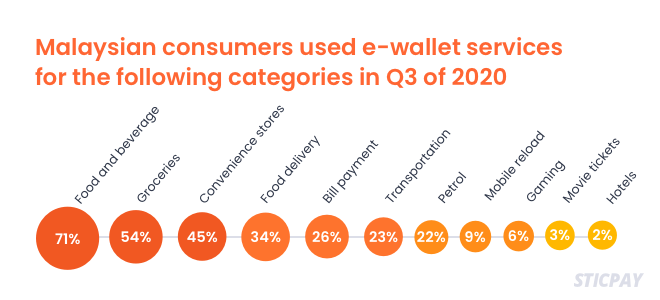

Some popular e-wallet purchases in Malaysia include food and drink (71%), groceries (54%), food delivery (34%) and fuel (22%).

While in Vietnam, the majority of street food vendors in Ho Chi Minh City accept the most popular 28 e-wallet solutions being used in the country.

Sending and receiving money remains a popular reason to use a digital wallet in Southeast Asia. In Singapore, 24% of people would choose to receive a repayment from a friend/family member via an e-wallet, with

Malaysia at 18%, Indonesia 18%, Taiwan 14% and Thailand 10%.

E-wallets Benefit E-commerce Businesses And Consumers

Ease of use and convenience are among the key reasons why digital wallet ownership is growing and benefits offered by award-winning STICPAY include:

- A global e-wallet service, operating in over 190 countries and offering accounts in 29 national currencies and cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC).

- Cost-effective and fast local bank wire transfers in Southeast Asia including Indonesia, the Philippines, Malaysia and Singapore. The local bank wire option allows you to receive and withdraw funds quickly and in your own currency.

- Consumers and merchants can use numerous payment methods to deposit and withdraw funds from their STICPAY accounts, including Visa, Mastercard, UnionPay China, local and international bank wire, and cryptocurrency.

- International money transfers can be made within minutes if both parties have a STICPAY account, with minimal fees (1% client-to-client domestic and international transfers, capped at $35).

- IOS and Android mobile apps and a web platform offer all users flexibility and easy access to funds and transfers.

- High levels of safety and security, with merchants and customers monitored with strict KYC (Know Your Customer) and AML (Anti Money Laundering) checks.

- STICPAY provides 24-hour customer service.

Join the e-wallet revolution

Digital wallets like STICPAY are aiding the huge growth in online spending in Southeast Asia.

Are you ready to join the e-wallet revolution?

Then register an account at STICPAY now!

Have you liked us on Facebook yet? Are you following us on Twitter and Instagram? Join STICPAY on LinkedIn!